Is The Next Economic Shoe Dropping?

Martin Crutsinger of the Associated Press reports, Consumer prices down 0.3 percent in March:

What else happened on Friday? Again, from Zero Hedge, the Atlanta Fed slashed its Q1 GDP forecast to 0.5%, the lowest in three years:

Go back to read my comment on why the reflation trade is doomed where I give you a global snapshot of why deflation remains a serious concern for monetary authorities.

Not surprisingly, after dismal economic data putting in question whether the Fed will continue hiking rates, the US dollar took a tumble, especially relative to the yen where it stands at a 5-month low:

Of course, every time there is weak US economic data making it less likely the Fed will hike rates, the US dollar declines and the dollar bears come out to growl. But as I explained in my comment on the greenback back in March, most of the recent decline in the US dollar can be explained by lopsided positioning as speculators were massively long the dollar following the election of Donald Trump.

From a macro perspective, the decline in the US dollar eases US financial conditions and acts like a cut in rates. The same goes for any country, a rise in its currency acts like a rate hike, a decline like a decline in rates.

What else? A decline in the currency raises import prices and stokes inflation expectations higher but conversely, an appreciating currency lowers import prices and pipeline inflation pressures. For small open economies, the effects are much larger.

Why am I sharing all this with you? It's critically important to understand currency dynamics in a deflationary world where rates are near record lows. This is where global inflation and deflation pressures play out and I would be very careful interpreting short-term trends in the US dollar here.

Why? Because as I keep telling you, the US economy leads the global economy by six months. So, even if in the short-term, the US dollar takes a hit, as currencies appreciate relative to the dollar, it tightens financial conditions in countries outside the US, many of which export to the US.

In other words, I don't buy the story that the greenback is set for a major decline. I would be using this selloff in the first half of the year to add to US dollar positions and keep in mind that as US data rolls over, global data will roll over too and real rate differentials will once again favor the US dollar. And if a crisis occurs later this year, global investors will run to the safety of US Treasuries and the US dollar.

If you look at the weekly chart of the US dollar ETF (UUP), you'll see despite the recent selloff, the greenback's ETF is still up since July 2015 and it will be interesting to see if it dips below its 50-week moving average and moves back up or bounces off it (click on image):

If the US dollar rebounds in the second half of the year, we can get that dollar crisis I warned of late last year, but it seems like the Trump Administration is well aware of this risk and trying to limit the odds of this outcome, talking down the dollar lately.

We shall see how it plays out but be careful reading too much into the US dollar's recent selloff, in my opinion, it's a temporary move due to bullish speculative positioning at the start of the year.

As far as stocks are concerned, given my views on the reflation trade being doomed, I would be actively shorting emerging markets (EEM), Chinese (FXI), Industrials (XLI), Metal & Mining (XME), Energy (XLE) and Financial (XLF) shares on any strength here (book your profits while you still can). The only sector I trade, and it's very volatile, is biotech (XBI) but technology (XLK) is also doing well, for now.

Still, early in the second quarter, high beta stocks are losing momentum and selling off. It's too early to tell whether we are in the early stages of a Risk-Off market but I still maintain that if you want to sleep well, buy US long bonds (TLT) and thank me later this year. In this deflationary environment, bonds remain the ultimate diversifier.

Hope you enjoyed this comment and I remind all of you to kindly donate or subscribe to this blog on the top right-hand side under my picture.

Also, the point of my macro comments is to make you think critically of what's going on out there and support you in your investment decisions. I don't proclaim to have a monopoly of wisdom on markets and the global economy, but I want to educate people on how to understand the bigger picture and think a lot more critically when interpreting economic and financial data.

Below, CNBC's Steve Liesman takes a look at the disconnect between hard and soft economic data. And Rodrigo Catril, currency strategist at NAB, says markets are caught up in the US President's comments on lower interest rates.

Consumer prices fell in March by the largest amount in more than two years, pushed lower by another sharp decline in the price of gasoline and other energy products.Friday was a big day for US economic data. Zero Hedge did a decent job covering a lot of the releases. First, it noted, "Reflation" Is Officially Dead: Core CPI Tumbles For The First Time In Over Seven Years, going over some charts and noting this:

Consumer prices dropped 0.3 percent in March following a tiny 0.1 percent rise in February, the Labor Department reported Friday. It was the first monthly decline in 13 months and the biggest drop since prices fell 0.6 percent in January 2015. In addition to a big 6.2 percent fall in gasoline prices, the cost of cell phone plans, new and used cars and clothing were all lower last month.

Core inflation, which excludes volatile food and energy, dropped 0.1 percent last month. Over the past 12 months, inflation is up a moderate 2.4 percent while core prices have risen 2 percent.

The Federal Reserve seeks to manage the economy to produce annual increases in inflation around 2 percent. But since the 2007-2009 recession, the worst downturn in seven decades, inflation for a number of years lagged below the 2 percent level, raising concerns that the economy could be in danger of toppling into a destabilizing period of falling prices, something not seen in America since the 1930s.

However, with steady gains in employment and a jobless rate now down to 4.5 percent, the lowest in nearly a decade, and energy prices rebounding, inflation is beginning to rise. The Fed last month boosted a key interest rate for the second time in three months and has projected two more rate hikes this year. Three rate hikes this year compare to single rate hikes in each of the past two years. The Fed uses higher interest rates to keep inflation under control.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said that the drop in prices in March could have been influenced by problems the government had in adjusting for Easter sales. He said if there were more of a slowdown in inflation in April that could force the Fed to change its plans for future rate hikes.

"Another month like March and a June rate hike will become less likely," he said in a research note.

For March, energy prices dropped 3.2 percent, led by the big 6.2 percent plunge in gasoline prices. Even with the decline, gasoline prices are 19.9 percent higher than a year ago.

Food costs edged up 0.3 percent last month but remain only 0.5 percent higher than a year ago.

Outside of energy and food, the prices of car insurance, medical care and airline fares were all up in March.

The biggest driver for the headline plunge was energy, which declined 3.2%, with the gasoline index falling 6.2%, and other major energy component indexes decreasing as well. The food index rose 0.3 percent, with the index for food at home increasing 0.5% its largest increase since May 2014.

But the real story was in the core number because CPI ex-food and energy dropped -0.1%, another huge miss to the +0.2% rise expected, and also the first - and worst - decline since January 2010 (click on image):

What else was released on Friday? Again Zero Hedge reports, retail sales declined for a second straight month as real earnings declined:

Among the core components, the shelter index rose 0.1 percent, and the indexes for motor vehicle insurance, medical care, tobacco, airline fares, and alcoholic beverages also increased in March. These increases were offset by declines in several indexes, including those for wireless telephone services, used cars and trucks, new vehicles, and apparel.

More details from the report that will likely assure that Yellen will not be hiking rates for a long time:

The index for all items less food and energy declined 0.1 percent in March. The index for communication fell 3.5 percent as the index for wireless telephone services decreased 7.0 percent, the largest 1-month decline in the history of the index. The index for used cars and trucks continued to fall, declining 0.9 percent in March, and the new vehicles index decreased 0.3 percent. The apparel index declined 0.7 percent in March after rising 0.6 percent in February.Even Shelter inflation is now rolling over (click on image):

The shelter index rose 0.1 percent in March, its smallest increase since June 2014. The rent index rose 0.3 percent and the index for owners' equivalent rent advanced 0.2 percent, but the index for lodging away from home fell 2.4 percent. The medical care index increased 0.1 percent in March, as the index for hospital services rose 0.4 percent, the index for prescription drugs was unchanged, and the physicians' services index declined 0.3 percent.

The index for motor vehicle insurance continued to rise, increasing 1.2 percent in March. The index for tobacco rose 0.5 percent, the airline fares index increased 0.4 percent, and the index for alcoholic beverages rose 0.2 percent. The indexes for recreation, for education, and for household furnishings and operations were unchanged in March.

For the second month in a row, retail sales declined in March as 'hard' data fails to live up to 'soft' data's hype. This is the biggest 2-month tumble in retail sales in over 2 years (click on image).

The full breakdown shows the biggest declines in building materials and motor vehicles (click on image).

This drop in sales should not be a total surprise as real average weekly earnings have now failed to rise for 3 straight months (click on image).

Two more 'hard' data series to add to the list that dismiss the hope embedded in all the soft survey data... but we are sure stocks know better.Indeed, as shown in the chart below, there is a disconnect between soft survey data and real economic data (click on image):

What else happened on Friday? Again, from Zero Hedge, the Atlanta Fed slashed its Q1 GDP forecast to 0.5%, the lowest in three years:

Just over two months ago, the Atlanta Fed "calculated" that Q1 GDP was going to be a pleasant 3.4%, confirming that the Fed had made the correct decision by hiking not only in December, but also last month. Since then, the Fed's own GDP estimate has crashed in almost linear fashion, and as of this morning - after the latest disappointing retail sales report - it had plunged to just 0.5%, which if accurate would make Q1 the weakest quarter going back three years to Q1 2014 (click on image).

From the regional Fed:No doubt, all this talk of the Fed hiking rates aggressively following the election of Donald Trump was premature. The Fed is data dependent and in my opinion, its number one concern remains global deflation spilling over into the United States.

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.5 percent on April 14, down from 0.6 percent on April 7. The forecast for first-quarter real consumer spending growth fell from 0.6 percent to 0.3 percent after this morning's retail sales report from the U.S. Census Bureau and the Consumer Price Index release from the U.S. Bureau of Labor Statistics.Putting the Atlanta Fed's forecast in context, a 0.5% GDP would mark the weakest quarter in 37 years, or going back to 1980, in which the Fed hiked rates. Then again, considering today's abysmal CPI and retail sales data, the narrative to focus on next is not so much hiking, or balance sheet normalization, but when the Fed will resume easing, cut rates (as per Donald Trump's recent suggestion) and/or launch QE4.

Go back to read my comment on why the reflation trade is doomed where I give you a global snapshot of why deflation remains a serious concern for monetary authorities.

Not surprisingly, after dismal economic data putting in question whether the Fed will continue hiking rates, the US dollar took a tumble, especially relative to the yen where it stands at a 5-month low:

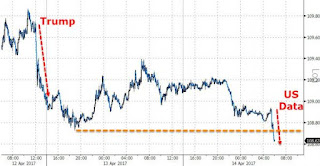

More indications that the US economy is not doing anything like as well as the soft survey data would suggest has sparked a fresh round of selling in USDJPY...(click on image):Against a basket of broader currencies, the US Dollar Index (DXY) has been losing steam since the beginning of the year (click on image):

Sending the yen to its strongest since just after the Trump election (click on image)

Of course, every time there is weak US economic data making it less likely the Fed will hike rates, the US dollar declines and the dollar bears come out to growl. But as I explained in my comment on the greenback back in March, most of the recent decline in the US dollar can be explained by lopsided positioning as speculators were massively long the dollar following the election of Donald Trump.

From a macro perspective, the decline in the US dollar eases US financial conditions and acts like a cut in rates. The same goes for any country, a rise in its currency acts like a rate hike, a decline like a decline in rates.

What else? A decline in the currency raises import prices and stokes inflation expectations higher but conversely, an appreciating currency lowers import prices and pipeline inflation pressures. For small open economies, the effects are much larger.

Why am I sharing all this with you? It's critically important to understand currency dynamics in a deflationary world where rates are near record lows. This is where global inflation and deflation pressures play out and I would be very careful interpreting short-term trends in the US dollar here.

Why? Because as I keep telling you, the US economy leads the global economy by six months. So, even if in the short-term, the US dollar takes a hit, as currencies appreciate relative to the dollar, it tightens financial conditions in countries outside the US, many of which export to the US.

In other words, I don't buy the story that the greenback is set for a major decline. I would be using this selloff in the first half of the year to add to US dollar positions and keep in mind that as US data rolls over, global data will roll over too and real rate differentials will once again favor the US dollar. And if a crisis occurs later this year, global investors will run to the safety of US Treasuries and the US dollar.

If you look at the weekly chart of the US dollar ETF (UUP), you'll see despite the recent selloff, the greenback's ETF is still up since July 2015 and it will be interesting to see if it dips below its 50-week moving average and moves back up or bounces off it (click on image):

If the US dollar rebounds in the second half of the year, we can get that dollar crisis I warned of late last year, but it seems like the Trump Administration is well aware of this risk and trying to limit the odds of this outcome, talking down the dollar lately.

We shall see how it plays out but be careful reading too much into the US dollar's recent selloff, in my opinion, it's a temporary move due to bullish speculative positioning at the start of the year.

As far as stocks are concerned, given my views on the reflation trade being doomed, I would be actively shorting emerging markets (EEM), Chinese (FXI), Industrials (XLI), Metal & Mining (XME), Energy (XLE) and Financial (XLF) shares on any strength here (book your profits while you still can). The only sector I trade, and it's very volatile, is biotech (XBI) but technology (XLK) is also doing well, for now.

Still, early in the second quarter, high beta stocks are losing momentum and selling off. It's too early to tell whether we are in the early stages of a Risk-Off market but I still maintain that if you want to sleep well, buy US long bonds (TLT) and thank me later this year. In this deflationary environment, bonds remain the ultimate diversifier.

Hope you enjoyed this comment and I remind all of you to kindly donate or subscribe to this blog on the top right-hand side under my picture.

Also, the point of my macro comments is to make you think critically of what's going on out there and support you in your investment decisions. I don't proclaim to have a monopoly of wisdom on markets and the global economy, but I want to educate people on how to understand the bigger picture and think a lot more critically when interpreting economic and financial data.

Below, CNBC's Steve Liesman takes a look at the disconnect between hard and soft economic data. And Rodrigo Catril, currency strategist at NAB, says markets are caught up in the US President's comments on lower interest rates.

Comments

Post a Comment